We Will Not Accept Any Decision That Undermines The State’s Fiscal Domain: Kerala Finance Minister

Mumbai: The finance commission is a constitutional body created every five years to decide on Centre-state financial relations. The latest panel constituted for 2020-2025 was asked to use the 2011 population census for deciding every state’s share of the central taxes. This may mean that states with higher populations will receive more central funds.

The decision quickly turned into a political controversy because it meant that India’s southern states--Tamil Nadu, Karnataka, Andhra Pradesh, and Kerala--would see a fall in their share of central taxes. In these states, progressive health and education measures ensured the population fell four percentage points to 21% of the national population in 2011 from 25% in 1971.

In comparison, the population of north Indian states--Uttar Pradesh, Bihar, Rajasthan and Madhya Pradesh--rose from 33% of the total population in India in 1971 to 37% in 2011, IndiaSpend reported on April 30, 2018.

The decadal growth in Kerala’s population between 2001-11 has been 4.8%, much below the national average of 17.6% over the same period. Kerala’s Communist Party of India (Marxist)-led Left Development Front government has been among those state governments including West Bengal, Andhra Pradesh, Delhi, Punjab, and Puducherry to oppose the commission’s decision.

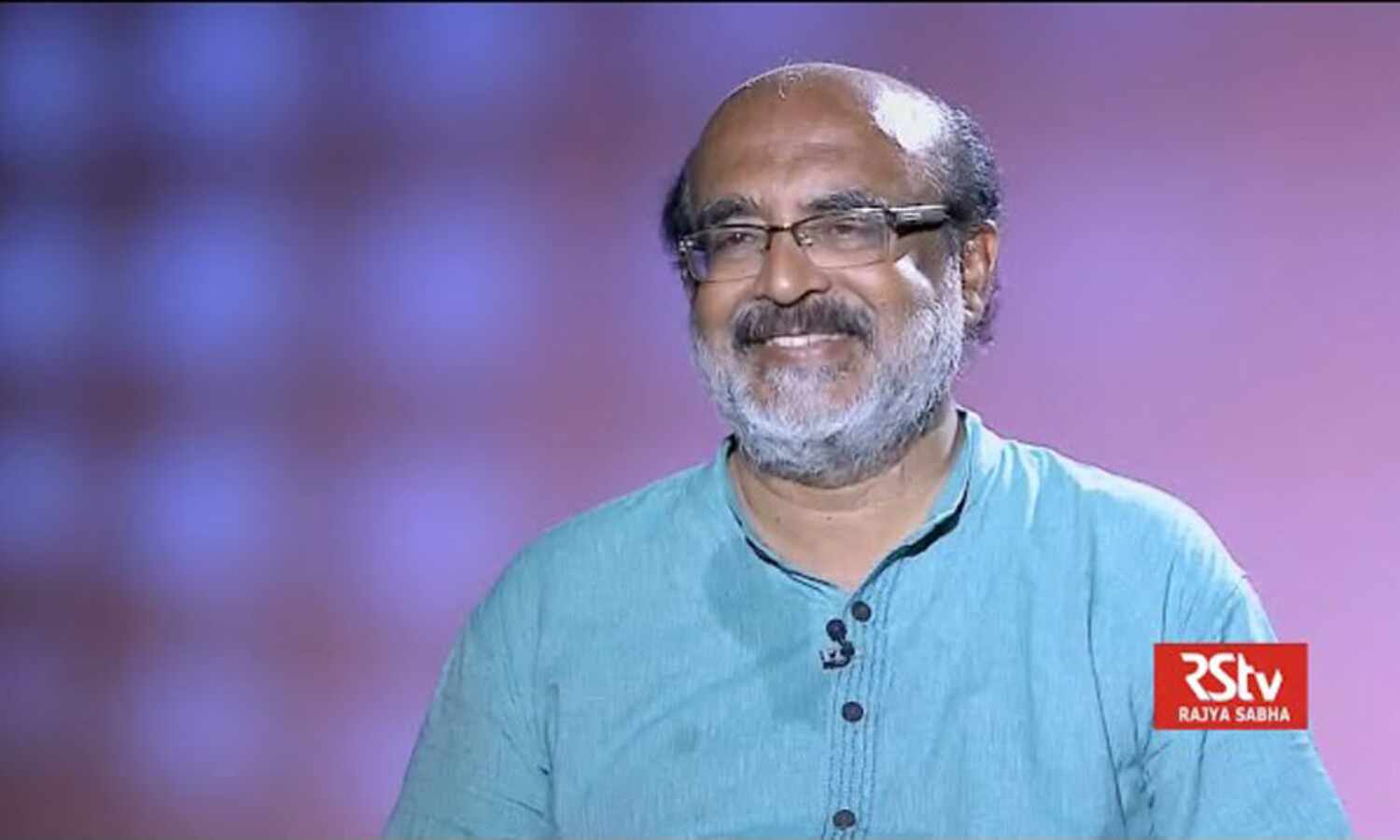

T M Thomas Isaac, 66, minister for finance and coir in Kerala, and a central committee member of the CPI(M) has been campaigning against the decision ever since it was announced. He believes its implementation would lead to financial disruption in the states. He also warned of a political fallout.

A day of involved dialogue with XV F.C. Our quarrel was not with the commission but with the TOR. The campaign against the TOR will continue. But the impression that I carry from the day is that the Commission will take an independent stand on some of the issues we raised.

— Thomas Isaac (@drthomasisaac) May 29, 2018

Memorandum submitted to the President argues that many of the clauses of TOR of 15th F.C. are unconstitutional or in contravention to well settled traditions of our fiscal federalism. Yet, some others are simply technically wrong.Sought Presidential intervention to amend TOR.

— Thomas Isaac (@drthomasisaac) May 17, 2018

Isaac is also upset with the implementation of the goods and services tax (GST). Though the collections are high--as per a government press release, these have hit a record mark of Rs 1.03 lakh crore in April, 2018--states haven’t benefited from the bounty, he said. In the eight months ending March 2018, around Rs 7.17 lakh crore--nearly one-third of the Centre’s budget for 2018-19--was collected. But the compensation paid for the revenue loss arising out of GST to the states between July 2017 and March 2018 was only Rs 41,147 crore.

In February 2018, Isaac advanced the state’s budget announcement to ensure sufficient time for the administration to implement plans from the beginning of the financial year. He is a four-time member of legislative assembly, an economist and a Kerala Sahithya Academy award winner for his book, Keralam: Mannum Manushyanum (2010), about social changes in Kerala and how these were influenced by international and local developments. In an interview with IndiaSpend, Isaac discusses concerns about the details of the finance commission, his government’s plan to introduce a healthcare plan financed by profits from the state lottery, and a budget analysis for the elderly in Kerala.

Although you’ve maintained that Kerala, as a consumer state, would benefit from the GST, you have also expressed your dismay at its implementation and the tax returns that Kerala has been receiving. What is the precise problem?

Since the introduction of the e-way (electronic way) bill [made compulsory for the movement all interstate goods], our checkposts have not been functional, leading to leakage of interstate trade. This has badly affected Kerala’s revenue where nearly 80% of commodities are brought in from outside the state. The return form [to file GST returns] is yet to be finalised. The 3B form [filed by everyone registered under GST] is only a summary statement of the voluntary declaration by the merchant. There is no way that we can check the veracity of input credit as some of the data is not available. Further, in order to scrutinise data, we do not want the annual return [of GST] to be postponed any further. All of this is affecting the collection of GST. The benefits that we were expecting in terms of revenue are yet to come.

What are the presumed benefits of the GST, and have these been realised yet?

Taxes have reduced sharply, but this is not reflected in the prices. To my knowledge very few commodities have seen a reduction in prices. It was a gain for corporates, while ordinary people did not benefit as much. The small-scale sector was hit partly because their excise exemption had to be given up.

Then, there are region-specific problems. The present GST does not permit any kind of regional independence. Everything must be confirmed by the GST Council. It would be useful if there is more room for choice on the rate of a commodity. This may be not possible for interstate trade, but can be done for the state’s GST. Further, the state suffers as the taxes have been subsumed, with a 50:50 share between state and Centre. This does not help the states. Overall, we are yet to accrue the benefits of the decisions. I’m optimistic that things will improve, but, so far it is gloomy.

You had stated that the attempt to implement the fiscal responsibility and budget management (FRBM) act--it seeks to set targets for the government to reduce fiscal deficits--without consulting states and the move to limit the borrowing power of states is a challenge to their financial independence. How do you foresee the future for state governments, especially at a time when the Centre is talking about cooperative federalism?

Many policy makers at the Centre seem to be obsessed with the country’s [credit] ratings. To improve the ratings, they want the fiscal deficit ratio to be reduced so that there is fund flow from outside. I believe that the state governments play an important role in development, especially in welfare and social and economic infrastructure. So, they [Centre] are taking the easy route by asking us to reduce the deficit. It is preposterous. We can’t accept that this must done for the benefit of some foreign power. This cannot be done by using the FRBM Act to bring down the fiscal deficit ratio. Since 2008, the Centre has a real deficit of around 4%. Even if you consider it to be 3.5%, it camouflages the figure. For example, the states deserve half of the estimated Rs 150,000 crore in the integrated GST. But they [Centre] have put it in their kitty to claim a lower fiscal deficit ratio. If they want to reign in states, why have state governments?

The details of the 15th finance commission stated that the 2011 population census would be used to consider allocations. There is a fear that this would adversely impact Kerala and other south Indian states which have been able to reduce their population by achieving replacement-level fertility rates. What do you think?

We are not against the finance commission. All we are demanding is that the it be allowed to perform its constitutional duty. The Centre must not micro-manage it or the details by adding [clauses] that tax devolution must be curtailed, borrowing power must be made conditional, etc. These are not aspects to be put here.

Every state’s share cannot rise, no matter what formula is used. It will vary. Let us create a rule that this variation is contained in a narrow band such that the finances of the state are not disrupted.

Presently, Kerala receives 2.5% of the central tax revenue. Kerala would receive less than 2% of the share if it is assumed that the 2011 population census is used with the same criteria as the 14th finance commission. If there is mechanical acceptance of the details of the commission, there is a danger of [financial] disruption at the state level. We want to avoid it. I want to make it clear that we will not accept any decision to undermine the state’s fiscal domain. We’ve already undergone this due to the GST, now we can’t have the finance commission cause further disruptions. But if anything of the nature happens, I am certain there will be a serious political fallout. We are keenly watching the situation. We have demanded of the President that the details be changed. After our discussions with the finance commission, I am positive about the changes. Till then we will continue our campaign.

The latest NITI Aayog health index has placed Kerala among the best performers alongside Tamil Nadu and Punjab. If the index is used to fix incentives from the Centre in terms of money, infrastructure, technology and so on to reduce last-mile development problems, do you fear that a top performing state like Kerala would lose out?

Some of the states are [performing] much above the national average. But these achievements have raised many second-generation problems which require expenditure intervention by the government. For example, due to universal education everyone aspires to receive quality education which demands huge state resources. We are seeing an increase in lifestyle diseases which require investments in speciality care.

Development does not mean that the expenditure requirements have reduced. At the same time, we must ensure that there is a minimum level of service across the country. No one can deny the need to transfer resources from developed regions to under-developed regions. I accept that. But, it must be done with a sense of proportion and must not disrupt the development process keeping in mind that it needs substantial resources.

In your budget speech, you proposed resource mobilisation for a comprehensive healthcare scheme using lotteries run by the directorate. The revenue receipt for lotteries is Rs 11,110 crore (budget estimate for 2018-19) and expenditure, Rs 7,874 crore. Will the government utilise the profit to include all beneficiaries in the Rashtriya Swasthya Bima Yojana and the new National Health Protection Scheme (NHPS)?

From what I understand, all households will not be covered in the new NPHS programme. We want to cover those left out too. A proportion of the households in the state are covered by employee and pensioners health programmes while the rest must be brought under health coverage. We do not want to just use an insurance programme. In Kerala, the public health system’s very important. Unlike the rest of India, we have a wide chain of government-run hospitals where service is provided. We want to link this programme to our public health system to handle the demand.

We are investing close to Rs 5,000 crore in the health sector hiring doctors, nurses, and paramedics to handle the demand that we foresee including speciality health services. We intend to provide people access and assured treatment at accredited and government hospitals. This would require a substantial amount of premium which will be provided through the lottery. The only justification for the lottery is that the profit will go into a social good. Through the lottery we are trying to tell people in Kerala that you can try your luck, but if you do not win, consider the investment a donation to the health sector. We expect to roll it out this financial year.

At 13%, Kerala has the highest proportion of people above 60. Despite its strong focus on health, Kerala has only spent 14% of the Rs 24.16 crore released by the national programme for the healthcare of the elderly under the non-communicable diseases flexible pool between 2015 and 2017 (as of December 2017). Considering that nearly 79% of elderly women and 21% of elderly men live alone in Kerala, what did you mean when you stated, during the budget this year, that “budget analysis for old age people will be started next year”?

There must be a focus on providing geriatric health service. The focus has been always on children which will have to change. In Kerala, there has been an emergence of a very active palliative care network which is important for elderly care. Any village in Kerala will have a palliative care unit. This needs to be supported. Nearly 5.2 million people are receiving some sort of pension from the government, although it may not be sufficient. Further we will also look to involve the elderly in social activities and local level development so that they feel wanted in society. We need to structure and design the system to incorporate this.

Although India continues to lead in receiving remittances in the world, inflows have declined by nearly 8.9%, according to a World Bank report. Remittances contributed to 36% of Kerala’s net state domestic product in 2014, down by 11% between 2014-16. With countries like Saudi Arabia, where nearly 23% of Kerala migrants work, encouraging nitaqat (system to encourage the employment of Saudi nationals in the private sector), how will your government tackle the return of workers and the resulting revenue strain?

Although slowly, the deposits being made are still on the rise. In 2015-16, it went down. Even with return migration, people come back with their savings ensuring buoyancy in remittances. Further, there is a diversification of migration to western countries. There is a deceleration in remittances and there is a possibility that it could decline over time and this can have an adverse effect on Kerala’s economy. Therefore, we have to hurry and diversify our production base to areas of modern industry and competencies. We are creating infrastructure to attract private capital in the preferred areas of investment.

You announced the formation of a Farmers Welfare Fund Board which will be funded partly by land tax collections and partly by a contribution to the agricultural worker welfare fund board. This would yield a monthly pension for farmers above 60 years of age. How will this develop?

The tax is estimated to be around Rs 150 crore. Every year around Rs 75 crore would go into the Farmers Welfare Fund Board, and farmers would also contribute. Over time there will be a substantial corpus for old-age pension and other social security programmes. The agriculture workers welfare fund board is the largest welfare fund board in Kerala, but has insufficient funds as matching grants have not been provided by the government and employers. Now, if half the land tax goes to them, they will be rejuvenated.

During your budget speech, you stated that nearly 140,000 students have transferred to government schools from unaided schools in Kerala. The state has had a strong legacy of literacy. In India, between 2010-11 and 2014-15, enrolment in governments schools fell by 11.1 million compared to an increase of 16 million in private schools. How has your government been able reverse the trend?

We are making huge investments in expanding and improving the quality of infrastructure in the public education system to digitalise classrooms and ensure that there are computer labs. We have raised the expectation of people regarding the public education system. Moreover, the fee is nominal as opposed to private unaided schools. This has helped lower middle class and poor families enroll their children back [to government schools]. The enrolment will see an increase anywhere between 150,000-200,000 in the current year.

(Paliath is an analyst with IndiaSpend.)

We welcome feedback. Please write to respond@indiaspend.org. We reserve the right to edit responses for language and grammar.

__________________________________________________________________“Liked this story? Indiaspend.org is a non-profit, and we depend on readers like you to drive our public-interest journalism efforts. Donate Rs 500; Rs 1,000, Rs 2,000.”