Nearly Rs 3 Lakh Crore Tax Yet To Be Collected

| Highlights * Nearly 81% companies and individuals paid tax voluntarily in 2010-11. * Authorities say they cannot find assets to collect taxes. * West Bengal had the highest value of tax assessments at Rs 2,637 crore.

|

Last week, we talked about the total tax collection and the number of tax payers in the country. This week, IndiaSpend’s Prachi Salve looks at the review process of tax returns filed by individuals and companies by the income tax department.

Two kinds of scrutinies are done by the tax department to figure out irregularities in payment of taxes by individuals and companies. First, summary assessments are done by the Assessment Information System (AIS) for regular checks of returns. Second, scrutinies are done in select cases by assessing officers for high tax paying individuals and companies.

Department Watching Tax Payers Closely

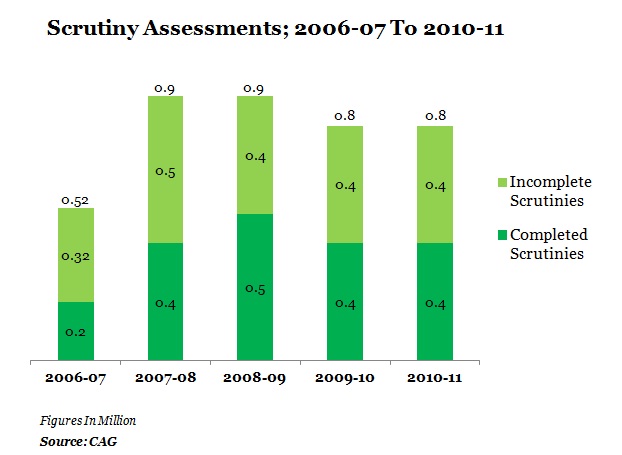

According to the latest report by the government auditor, Comptroller and Auditor General of India, a total of 0.85 million scrutinies were done in 2010-11… and the tax department completed assessment of 53.7% or 0.46 million cases. This has led to an increase in the number of pending cases (for assessment) from 0.28 million in 2006-07 to 0.39 million in 2010-11.

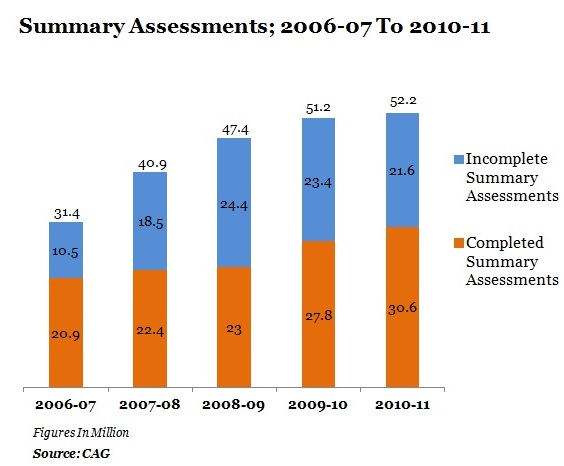

In 2010-11, 52 million cases were assessed by the department out of which 31 million cases were disposed. So, this has led to an increase in the pendency rate from 33.2% in 2006-07 to 41.4% in 2010-11.

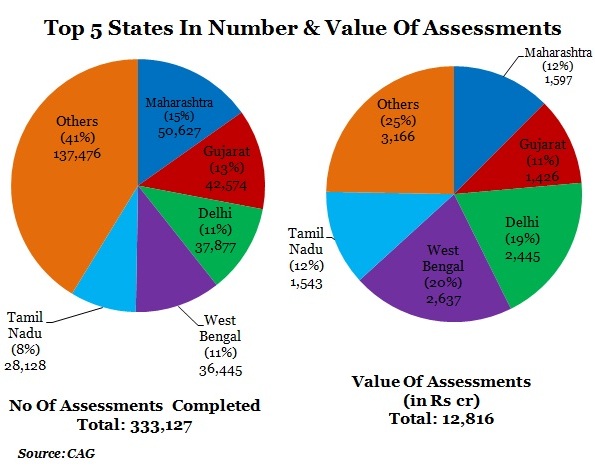

Figure 1 (a)

Figure 1 (b)

There was a spurt in scrutiny between 2007 and 2009 to nearly a million cases even though the total assessments were steady around 40 million. The auditor’s report has no mention about the increase in scrutinies.

High Voluntary Compliance

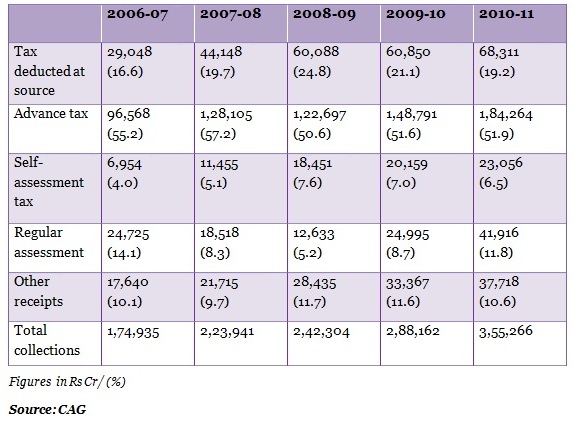

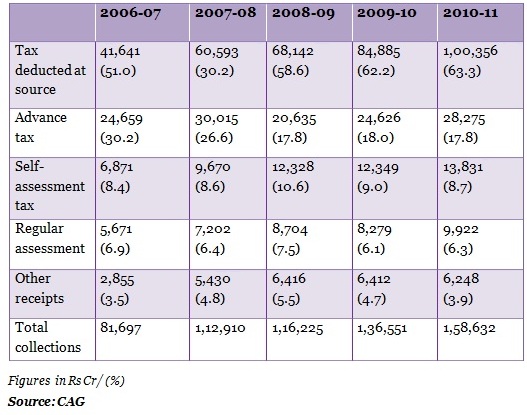

Nearly 81.4% companies and individuals paid tax voluntarily 2010-11. Gross tax collections, which includes tax deducted at source, advance tax, self-assessment and other receipts, in the pre-assessment stage totaled 77.6% and 89.8%, respectively, for corporates and individuals. While advance tax formed the highest portion with nearly 52% collection from corporate assesses in 2010-11, tax deducted at source was the major part (63.3%) in the non-corporate tax collection during the same period.

The regular assessment increased for corporate assessees to 11.4% in 2010-11 from 8.4% in 2009-10. In case of non-corporate assessees, it has always been around 6-7% during 2006-07 to 2010-11.

Table 1.1: Corporates Prefer To Pay Advance Tax

Table 1.2: Direct Tax Deduction Better Option For Individuals

Watch Maharashtra, West Bengal Data

West Bengal, Maharashtra, Tamil Nadu, Delhi and Gujarat are the top five states with respect to tax scrutinies and tax to be collected. While Maharashtra had the highest number of completed assessments, West Bengal had the highest value of assessments with Rs 2,637 crore.

Figure 2

Coming to the lowest states in value of assessments, Uttaranchal (Rs 0.74 crore) tops the list followed by Himachal Pradesh (Rs 3.19 crore) and Jharkhand (Rs 4.63 crore).

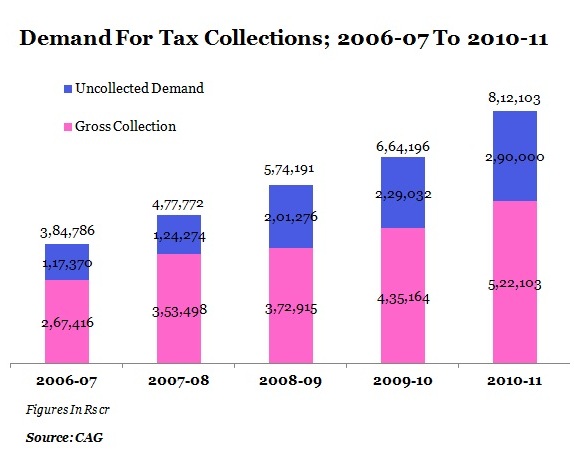

High Uncollected Tax Demand

A tax demand is known as the amount expected to be paid by the taxpayer after scrutiny is carried out. A total of Rs. 2.9 lakh crore remained uncollected in 2010-11, which includes the earlier demand of Rs 2 lakh crore and the current uncollected demand of Rs. 0.9 lakh crore.

According to tax authorities, collection of taxes is affected as they cannot find assets and companies are being liquidated.

Figure 3

So, despite the growth in tax collections, the increasing uncollected demand shows the actual potential of taxes that can be collected and used for development purposes within the country.