Close To 90% Of Cheques Written Are Still Below Rs 1 Lakh

Is India moving towards a cashless society? So it seems if we look at data released recently by the country’s central bank, the Reserve Bank of India (RBI) comparing electronic payments and usage of cheques for payments.

Is India moving towards a cashless society? So it seems if we look at data released recently by the country’s central bank, the Reserve Bank of India (RBI) comparing electronic payments and usage of cheques for payments.

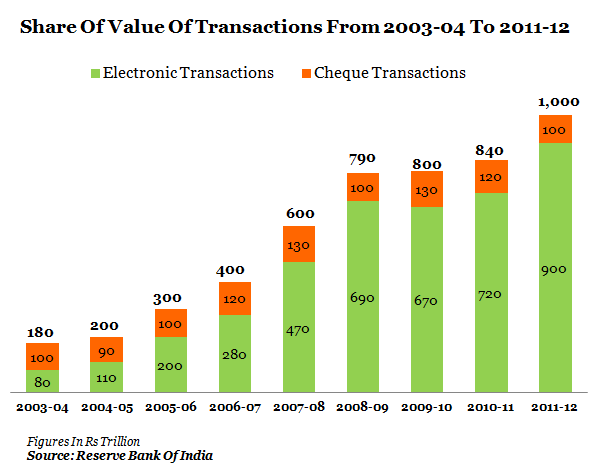

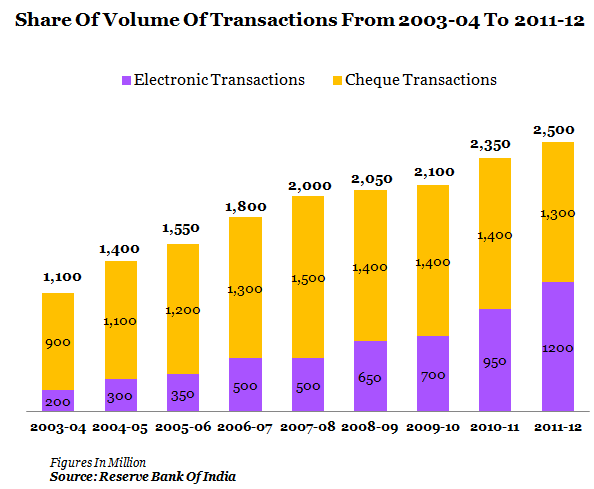

IndiaSpend’s Sourjya Bhowmick looked at the report and here are some key findings: there is a growing trend towards electronic payments (around 90% of the total value of Rs 1,000 trillion in 2011-12 was through electronic mode) but nearly 52% of the total volume of payments was done through the manual mode of cheques.

Put differently, 89% of the cheques cleared during the first half of the current financial year (2012-13) amounted up to Rs 1 lakh and only 9% cheques cleared were between Rs 1 lakh and Rs 5 lakh.

According to the RBI report titled Disincentivising Issuance and Usage of Cheques, the shift from cheques to e-payments seems inevitable but the shift must not affect any section of the society as it is estimated that 480 million Indians still do not have access to banking at all – either cheques or e-payments.

Financial inclusion in India’s 600,000 villages continues to be a distant dream if you compare with China, which already claims total banking coverage in all its 1 million villages. Banking services in India still cover only 74,000 villages with a population of more than 2,000. The target is to cover 348,000 villages with a population of more than 1,000 by March 2013.

Figure 1

So, it is evident that the share of electronic payments has been steadily rising over the years, and the share of cheque transactions has been coming down since 2008-09. However, the number of cheques issued for total payments remain high (at nearly 52%) as shown in Figure 2:

Figure 2

It is seen that while the volume of electronic transactions is rising, the volume of cheques has almost remained the same without major fluctuations. So, what are the reasons for high cheque usage? The RBI attributes many reasons for this including:

1) Cheque was the only alternative to cash payment for a long time, and has thus percolated all segments of society. Consumer mindset does not change swiftly with the advent of electronic transfers, which is not a tangible instrument.

2) Electronic payment requires additional details such as the account number, name of bank/branch etc as compared to cheques that act as impediments for the user to come out of the comfort zone.

3) Low awareness and accessibility also creates misconceptions; and

4) Electronic payments are ‘credit push’ in nature which requires the payer to have funds at the time of payment. However, cheques have a ‘time window’ between issuance and clearance, which gives time to deposit the amount. Time window further aids when the payee delays collection of cheques and the payer is benefited due to the delay.

It is evident that though the value of transaction is increasing, majority of the transactions are still done through cheques. To manage the usage of cheques, the RBI mandated in August 2008 that all payments above Rs 10 lakh between RBI-regulated entities and RBI-regulated markets have to be done electronically.

RBI says that low awareness deters users from moving to electronic payments, and basic steps like addressing complaints can push more users to the new mode of payment. Other ways to control the usage of cheques, as recommended by RBI, are imposing levies on both parties and limited issuance of cheque books. However, RBI also does not deny that avoiding cheques can lead to more cash-based transactions, which is not desirable.