Budget 2013: Subsidy Bill Continues to Balloon, Healthcare Still A Dream

Finance Minister P Chidambaram left a lot of questions raised in IndiaSpend’s primer series unanswered in Budget 2013-14. Let us start with subsidies and health spending.

Finance Minister P Chidambaram left a lot of questions raised in IndiaSpend’s primer series unanswered in Budget 2013-14. Let us start with subsidies and health spending.

Question #1) Will there be a ceiling on food subsidy?

We see that food subsidy has been budgeted at Rs 80,000 crore for 2013-14 - an increase of Rs 5,000 crore over the budgeted amount of 2012-13. Incidentally, the revised amount of food subsidy for 2012-13 stands at Rs 85,000 crore. Therefore, the amount allocated for 2013-14 is actually lower than the revised estimate of 2012-13.

The National Food Security Bill, which is expected to be passed in the Budget session, has seen a special budgetary allocation of Rs 10,000 crore. The Bill proposes a legal right to over 5kgs of foodgrain to over 70% of the population, which may result in additional subsidy allocation.

So, the allocation (Budget estimates of food subsidy + special allocation for National Food Security Bill) for food distribution in Budget 2013-2014 is Rs 90,000 crore though there are chances of the total food subsidy crossing Rs 100,000 crore by the end of the financial year.

Question # 2) Will oil prices be aligned with global prices to reduce under-recovery?

The alignment would mean higher prices for consumers but lesser 'under-recoveries’ for oil companies. Subsidies are given to oil companies to partly compensate for the under-recoveries for sale of petroleum products below cost.

A sum of Rs 40,000 crore was budgeted for under-recovery payments in 2012-13, which has gone upto Rs 93,500 crore (revised estimates), an increase of 133%. Budget 2013-14 allocates Rs 61,772 crore for payments of under-recoveries. If we see the same trend, India’s petroleum subsidy bill will also cross Rs 100,000 crore.

No steps have been announced in Budget 2013-2014 to reduce under-recoveries of oil companies. Petrol prices were increased by Rs 1.40 from March 1, 2013. Petroleum companies have cited the increase in international crude oil prices and rupee depreciation, leading to rise in import prices, for hiking prices. However, it will not make much difference to the petroleum subsidy because diesel, cooking gas and kerosene continue to be subsidised heavily. The government has allowed oil marketing companies to raise diesel prices by up to 50 paise per month and has capped subsidised cooking gas to 9 cylinders per year, which is likely to reduce under-recovery of oil companies in 2013-14.

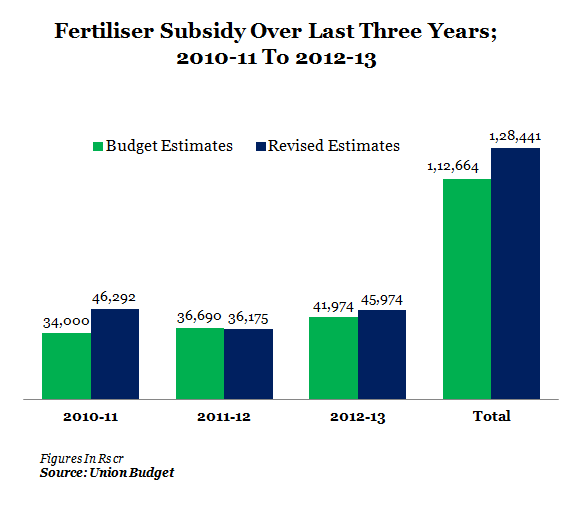

Fertiliser subsidy is another big cash guzzler... fertilizer subsidy is paid to import fertilisers and also to manufactures for concessional sale. Figure 1 gives an idea of how much has been paid as fertiliser subsidy for the last 3 years:

Figure 1

Around Rs 112,664 crore was budgeted for fertiliser subsidy between 2010 and 2012-13, and the revised estimates stood at Rs 128,441 crore, which is 15,777 crore higher (around 14%). The budget estimate for fertiliser subsidy next year is Rs 44,972 crore.

So, the subsidy budgeted for 2013-14 (food+petroleum+fertiliser) is Rs 186,744 crore.

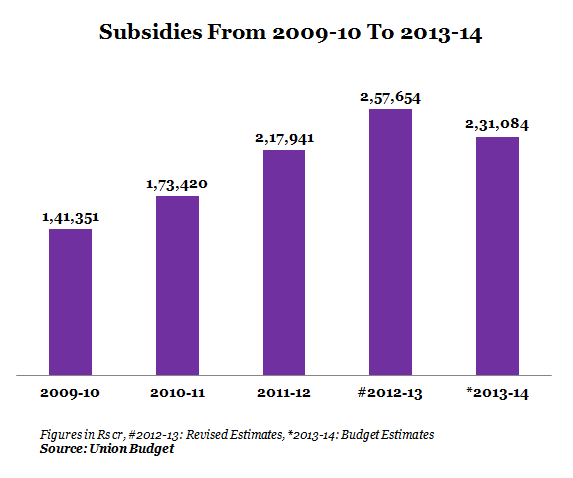

Figure 2 below shows the total subsidies from 2009-10 to 2013-14:

Figure 2

If the trend continues in the same vein as the last few years, it can be assumed that the total subsidy bill will cross Rs 2 lakh crore at the end of the year, which seems to be within the targeted 2% of GDP.

Question #3: Will the total health budget reach the desired level of 2% of GDP?

The GDP for 2013-14 is projected at Rs 113,71,886 crore. And the total budget for the Ministry of Health and Family Welfare is Rs 37,330 crore, which is not even 0.5% of GDP.

Incidentally, India’s health expenditure as a percent of GDP has always been hovering around 1-2%, and was ranked 185thamong a total of 190+ countries in 2009. The Planning Commission, in the past, had suggested that healthcare spending should be increased to 2-3% of GDP. There is still 60% shortage of specialists in rural India and high maternal mortality and infant mortality rates compared to developed nations.

Question #4: Will the outlay for National Rural Health Mission (NRHM) increase keeping in mind the under-utilisation by the states? And would any steps be taken for faster implementation of National Urban Health Mission (NUHM)?

Budget 2013-14 has announced that NRHM has been combined with NURM, and will henceforth be known as National Health Mission. The programme gets Rs 21,239 crore, an increase of over 20% over the revised estimates of 2012-13 which is Rs 15,411 crore.

This raises another important question: will this amount be able to address all healthcare needs of 830 million rural people and around 80 million poor people living in cities and towns of India? Incidentally, the revised estimates for NRHM in 2012-13 show that there is an under-utilisation of around 16% from the Budget Estimates of 2012-13 (Rs 18,515 crore).

Six All India Institute of Medical Sciences (AIIMS) have been on the anvil since 2004. The first batch of students was admitted in the session that commenced from September 2012. On the negative side, hospitals have not yet started and will function from 2013-14. An allocation of Rs 1, 975 crore has been provided for the initiative. In Budget 2012-13, Rs 1,544 crore was provided out of which only Rs 1,010 crore was spent. Incidentally, nothing has been mentioned about the upgradation of 26 medical colleges across the country.

IndiaSpend has been following the healthcare sector closely, and we have found that infrastructure, personnel and key indicators show a dismal state of affairs. India will also be missing the Millennium Development Goals that are linked to the healthcare funding and performance of the country on health indicators.

While the subsidy bill for the Government keeps increasing every year, the question is whether it reaches the targeted population. While Budget 2013-14 does mention using Aadhaar (biometric identities) for better targeting of subsidies, a lot still needs to be done.... and the dreams of healthcare for all may continue to be a mirage. IndiaSpend will look at other issues raised in the primer series like spending on infrastructure, rural development and current account deficit soon.