An Interim Budget On Auto Mode: Quick Glance

Finance Minister P Chidambaram refrained from announcing any populist measures in the final Budget of the United Progressive Alliance (UPA) II Government but did offer concessions to automobile and durable goods manufacturers to woo the Aam Aadmi.

Chidambaram said the Government may lose Rs 300-400 crore for the remainder of the current financial year due to the cuts but it could be made up if the automobile companies are able to sell more vehicles.

The Finance Minister managed to deliver on the fiscal deficit, the difference between Government income and expenditure, target by promising to contain it at 4.6% of GDP against the Budget target of 4.8%. And he has set a fiscal deficit target of 4.1% of GDP for 2014-15.

Let us look at the revenue estimates of the vote-on-account presented today:

The estimated revenue for the year 2014-15 is Rs 17,63,214 crore, which is an increase of 11% compared to the 2013-14 Revised Estimate of Rs 15,90,434 crore. And gross tax revenue is expected to increase 19% to Rs 13,79,199 crore. Non-tax revenue is likely to decline over 6% to Rs 1,80,714 crore from the Revised Estimate of Rs 1,93,226 crore.

The share of direct taxes is expected to increase from Rs 6,36,318 crore in 2013-14 (RE) to Rs 7,58,421 crore in 2014-15. Indirect taxes, which are expected to be 47% of the total tax revenue, is expected to increase 19% compared to 2013-14.

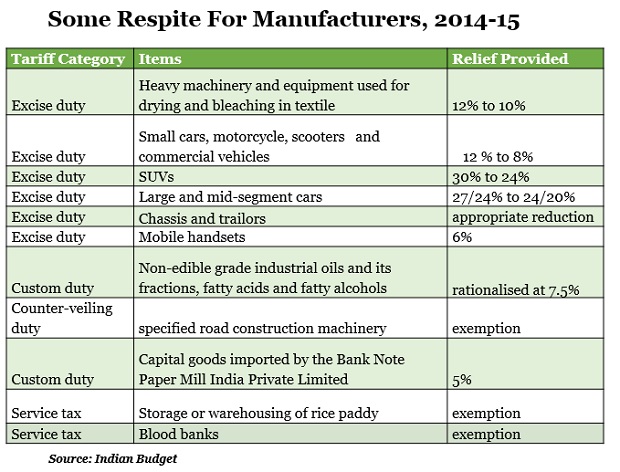

In an effort to boost the manufacturing sector, the Government announced relief for some sectors with respect to excise and custom duties and service tax.

Table 2

Let us now look at the expenditure side of the budget:

Total expenditure under the interim budget for 2014-15 is estimated at Rs 17,63,213.9 crore, an increase of 11% from the expenditure under revised budget for 2013-14. Non-plan expenditure at Rs 12,07,892 crore is an increase of 8% from the revised estimate of Rs 11,14,902 crore in 2013-14.

The non-plan expenditure for interest payment and debt services for 2014-15 is estimated at Rs 4,27,011.3 crore, accounting for 35% of the total estimate. Defence expenditure for 2014-15 is likely to increase 10% with an allocation of Rs 2,24,000 crore. The Finance Minister also allocated Rs 500 crore to implement the One Rank One Pension (OROP) for the defence personnel.

Total non-plan expenditure on subsidies for 2014-15 is estimated at Rs 2,55,707.62 crore, a marginal increase of Rs. 191.3 crore. Food subsidies for 2014-15 are estimated at Rs 1, 15, 000 crore including the allocation to implement the National Food Security Act.

Petroleum subsidy for 2014-15 is estimated at Rs 63,426.95 crore, and the Finance Minister said Rs 35,000 crore from the fourth quarter of the current financial year has been rolled over to the first quarter of 2014-15.

The total plan outlay under the interim budget is Rs 5,55,322 crore, which is an increase of 17% over the revised figure for 2013-14. Interestingly, the budget estimate for 2013-14 also was Rs 5, 55, 322 crore.

The minister highlighted a few ministries where an amount equal to or higher than the budget estimates of 2013-14 has been allocated in 2014-15. The ministries include:

While the gender budget for 2014-15 will be Rs. 97, 533 crore, the child budget will be Rs 81, 024 crore. The Finance Minister has declared additional central assistance of Rs 1,200 crore to North-east states, Himachal Pradesh and Uttarakhand.