$95-Billion Tax Benefits for Companies, Individuals, Up 7%

While the central government is expected to earn a tax revenue of Rs 919,842 crore ($148 billion) for the financial year 2015-16, it is expected to forego revenue of Rs 589,285.2 crore ($95 billion) in 2014-15 due to exemptions granted to companies and individual taxpayers.

This forgone revenue, or tax benefits, is twice the defence budget allocation of Rs 247,000 crore in 2014-15.

Tax-revenue forgone is a contentious issue--an "incentive" or a "sop", depending on ideological position--and becoming more so at a time when the National Democratic Alliance government plans cutbacks to India's subsidy bill of Rs 2,27,287 crore ($36 billion).

While India's subsidy bill is likely to fall almost 10%, the tax-revenue forgone is expected to increase by 7% from 2013-14.

Those on the left hold "sops"--such as accelerated depreciation, deduction of export profits of units located in special economic zones (SEZs), area-based exemptions and waivers on import duties--as evidence of government largesse to business at the expense of the poorest. Those on the right argue that tax-revenue forgone is an important business "incentive" to help the economy grow, without which the needs of the poor cannot be addressed.

Two days after Budget 2015, Professor Ashutosh Varshney, SoI Goldman Professor of International Studies and Social Sciences at Brown University had this twitter exchange with economist and former chief economic advisor Arvind Virmani:

Without incentives to business, high growth can't be restored in India. But no Indian govt. can swear by a pro-business ideology. (2)

— Ashutosh Varshney (@ProfVarshney) March 1, 2015.@ProfVarshney State socialists & their capitalist cronies love special exemptions. Market economists like us want neutral tax regime(compet

— Arvind Virmani (@dravirmani) March 2, 2015

Revenue forgone includes exemptions granted to companies and individual taxpayers.

For instance, customs-duty exemptions on precious stones and jewellery - an effort to boost the labour-intensive industry of polished gems and jewellery , India's second highest export earner of principal commodities, are expected to reduce government revenue by Rs 75,592 crore in 2014-15.

Exemptions on import duties of mineral fuels and mineral oils -- designed to keep cost of imports low since India is totally dependent on oil imports while petro products also play a big role in exports - are likely to reduce government revenue by Rs 72,180 crore.

Individual tax payers get various deductions, such as rebates for repayment of housing loans and investments in pension funds and medical insurance. So, for example, rebates on repayment of housing loans, investment in life insurance policies etc (categories that fall under Section 80C) will reduce revenue by Rs 29,237 crore in 2014-15.

Given the polarised nature of the debate, some argue that many tax exemptions are wrongly listed.

“Most concessions included in revenue foregone undoubtedly contribute to enhancing public welfare or promoting exports. These should not be included in estimates of revenue forgone," wrote Rajiv Kumar and Geetima Das Krishna, senior fellow and senior researcher at the Centre for Policy Research, New Delhi, in Mint. "Therefore, the finance ministry would do well to come up with a new methodology for calculating the actual revenue foregone and a new nomenclature for genuinely effective tax incentives. It is important to deny the ideologues this annual tamaasha (drama) of private-sector bashing.”

There's a related issue: companies are also given tax incentives, and they pay lower taxes than individuals. The larger the company, it appears, lower the tax rate.

Why do companies pay lower tax than individuals?

Revenue forgone includes income-tax exemptions as well, almost 95% given to companies, the rest to individuals.

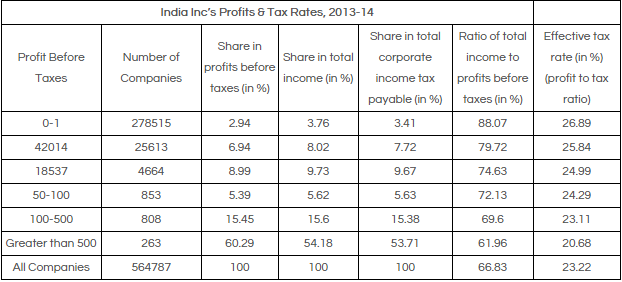

The effective tax rate for 564,787 companies that filed electronic returns for the financial year 2013-14 was only 23.22% while the standard rate varies between 33.21% and 33.99%.

Source: Budget 2015

The statement on revenue forgone, issued with Budget 2015, had this to say: “Companies with profits before taxes (PBT) of Rs 500 crore and above accounted for a total of 60.29% of the total PBT and a total of 53.71% of the total corporate income tax payable. However, their effective tax rate was 20.68% while the effective tax rate was 26.89% for companies with PBT up to Rs 1 crore.”

Clearly, bigger companies are paying lower taxes.

Services, a growing sector of the economy, were clearly pulling their weight. Their effective tax rate was 24.37%, for instance, compared to manufacturing's tax of 21.96%.

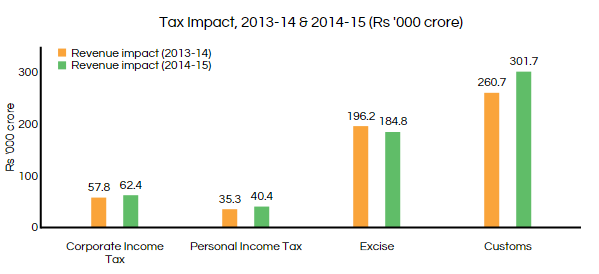

The revenue impact due to the major incentives offered to corporate tax payers is expected to be Rs 62,398.60 crore in 2014-15, against Rs 57,793 the previous year, an increase of 8%.

The revenue impact of incentives given to individual tax payers, such as investments in insurance premiums, health insurance and donations, is likely to increase 15%, from Rs 30,771.8 crore in 2013-14 to Rs 35,293.6 crore in 2014-15.

The aggregate revenue impact due to incentives for indirect taxes is expected to be Rs 486,452 crore.

Source: Budget 2015

While individual tax payers account for only 6% of tax benefits, corporates, importers and exporters get 94% of such benefits.

The 14th Finance Commission, which submitted its report to the Finance Minister recently, also spoke about revenue forgone. "Revenue forgone as estimated by the Union Government reached a peak of 8.1% of GDP in 2008-09 and as a percentage of gross tax revenue, it was the highest (77.3%) in 2009-10. Since 2004-05, revenue foregone has always been in excess of 5% of GDP."

______________________________________________________________________________

“Liked this story? Indiaspend.org is a non-profit, and we depend on readers like you to drive our public-interest journalism efforts. Donate Rs 500; Rs 1,000, Rs 2,000.”