5 Things The J&K Budget Can Teach India

“I am asserting that I shall not go with a begging bowl to New Delhi. This despite the fact that we not only have a friendly government at the Centre, we also have an exceptionally sensitive and accommodating Union Finance Minister. By doing so, I do hope to restore the dignity of the people of J & K who are forever being accused of surviving on subsidies and largesse. The goal of our government is economic self-reliance and fiscal autonomy.”

- Haseeb Drabu, Finance Minister, Jammu & Kashmir

A former banker, editor and now full-time politician, regarded as a “renegade” by Kashmiri separatists who once believed he was one among them, has just set the tone for budget-making for Indian states in the era of Narendra Modi.

In line with the Prime Minister’s intention to devolve more power and finances to the states, the seasoned Drabu, 54— economist from Delhi’s Jawaharlal Nehru University, former bank chairman, former columnist with Mint, editor of business-standard.com and member of legislative assembly from Rajpora, J&K—presented last week a budget that aimed at financial independence.

“I shall not seek any financial assistance or grants from the Centre other than what is provided for in the Constitution of India for all the special category states as a part of the federal fiscal system,” said Drabu, author of the first budget of the People’s Democratic Party (PDP)-Bharatiya Janata Party (BJP) alliance.

Here are five things that stood out in Drabu’s budget:

1) Plain speaking on wasteful government

Here’s what Drabu said about his own government: “To spend Rs 10,000 crore on the economy, the government is spending nearly three times (Rs 30,000 crore) that amount on the machinery that spends Rs 10,000 crore!”

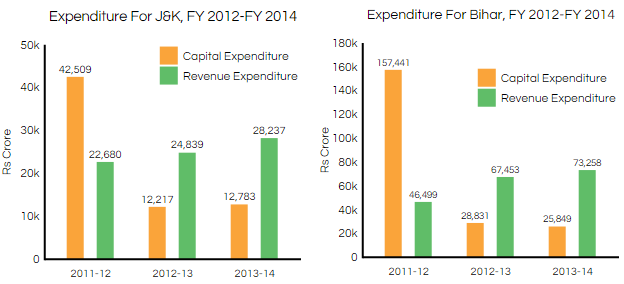

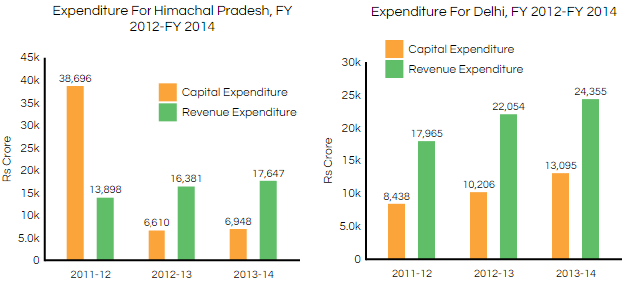

J & K, along with Bihar, Himachal Pradesh and Delhi, spends more money on revenue expenditure—which includes salaries, pensions, interest payments and other money that the government spends on itself—than on capital expenditure to build assets and other infrastructure for the people, according to a state-budget analysis by the Reserve Bank of India.

Source: RBI; Figures in Rs crore

The financial year 2011-12 was a year of high capital spending for all the three states. However, in the following years, 2012-13 and 2013-14, it is clear that revenue expenditure is far higher than capital spending in the three states as well as Delhi. This means governments that spend more on themselves than on the people they govern.

Drabu also explained his government’s spending plan in 2015-16: Rs 11,246 crore for building assets and Rs 35,227 crore for revenue expenditure. Obviously, knowing what’s happening and changing it immediately is a tough ask.

“In the next budget, we will provide details of the physical assets that have been created on the ground by the money that was spent,” said Drabu.

The Finance Minister promised a law that would allow money to be borrowed only for financing capital assets. IndiaSpend previously reported how Maharashtra has built up a debt of $48 billion and now must borrow money to repay borrowed money.

Haseeb also did some plainspeaking when he emphasized job creation over asset creation: “Jab dukan chal padaygee, makaan toh bun hi jayegaa!” (When businesses will run, houses will get made).

2) Simple accounting: income & expenditure

With one stroke, Drabu has rewritten the rules of budget-writing and accounting.

It’s very easy to understand where the money is coming from and where it will go. Gone are those confusing terminologies beloved of Indian financial babudom, such as plan, non-plan, capital, revenue and non-revenue.

Starting from the next fiscal year, 2015-16, the budget will have only two parts: receipts and expenditure.

“The expenditure budget will, in turn, have only revenue and capital expenditure estimates,” said Drabu. “The entire old classification of the plan and non- plan has been discarded. This is a major change which has far reaching implications on the allocation, efficiency and monitoring of public expenditure. This change will demystify the budget to a great extent."

“Now there will be only two categories of expenditure, current and capital; the former being what is spent to meet our daily expenses and the latter is what is spent on making assets on the ground. In the years to come, we can start the mapping of asset creation with money that has been spent.”

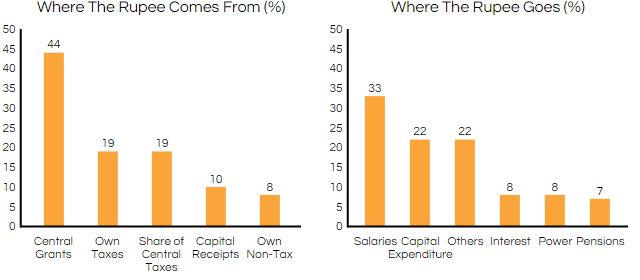

Drabu’s budget calculations are simple: total revenue receipts: Rs 42,137 crore; total public expenditure: Rs 46,473 crore; resource gap (46,473-42,137= Rs 4,336 crore). And this Rs 4,336 crore is to be “financed by prepositioning of the 14th Finance Commission grants without seeking any additional funding”. That’s Drabuspeak for no favours from Delhi.

Source: J&K Budget, 2015-16

3) Protecting the vulnerable: small businesses, farmers, women

Drabu has balanced fiscal responsibility with subsidies and handouts that could allow vulnerable people in his flood-ravaged province to become self sufficient.

Some examples:

- Waive 50% of the Kisan Credit Card (KCC) loans of farmers who have an outstanding balance of less than Rs 1 lakh. Cost: Rs 150 crore.

- For 50,000 widows: zero balance savings account, life insurance cover of Rs 25,000, accident cover of Rs 25,000 sickness/disease cover of Rs 5,000 and maturity/survival benefits of Rs 25,000 after five years.

- Rs 1,000 per month to every girl for 14 years from birth. At 21 years, she will receive about Rs 6.5 lakh. This handout is to address the state’s low sex ratio. Cost: Rs 35 crore.

Here’s a look at the six possible districts in J & K where the programme could be implemented—it will begin as a pilot project—based on the 2011 census:

Source: Census 2011

Jammu & Kashmir has seen the child sex ratio (females per 1,000 males) decline to 859 in the 2011 census from 941 in the 2001 census.

4) Taxing services to increase revenue

Drabu intends to balance dole handouts with new sources of revenue.

“J&K is the only state in the country that has the power to tax services,” he said. “By virtue of the Goods & Services Tax (GST) Act, J&K has the power to tax both goods and services. All other states of India have the power to tax only goods. The moot point is that J&K is a special taxation area. Given the fact that according to latest estimates, service sector constitutes 57% of the GSDP (gross state domestic product), its contribution to the state exchequer is next to nil. So far, we have not been able to tap the entire potential of this sector.”

So, included under the tax net now are advertising agencies, security services, placement services, salons and health clubs. This should generate Rs 150 crore.

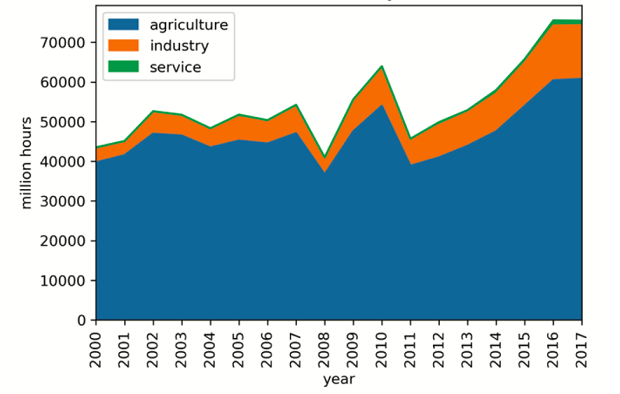

Services make up nearly 60% of India’s gross domestic product, and services are taxed in India based on the negative list regime (not covered under service tax act including services provided by central/state governments and RBI). IndiaSpend had earlier reported how service tax collection was expected to be higher than other taxes in 2014-15.

5) A budget for the main economic bottleneck—electricity

Drabu also presented a 41-page power budget for J&K, a first for any Indian state, most of which face economic bottlenecks because of electricity shortages.

He said power-sector development held the key to fiscal autonomy through 24x7 “reliable and affordable power to all domestic, commercial and industrial consumers” and “unleashing of a new era of development”.

Presenting a detailed plan of what he hoped to do, Drabu said 57 projects—hydel, solar and thermal—with a capacity of 9344 MW (mega watt) are planned. They require an investment of Rs 1 lakh crore ($16 billion).

The state faces a peak deficit of 22%. Electricity demand is 2,657 MW in 2014-15, of which only 2,050 MW is likely to be met.

Our verdict: Drabu’s budget is an effort to set a new tone in budget-making in India—from a state that appears to be perpetually at conflict with India.

_____________________________________________________________________________________

“Liked this story? Indiaspend.org is a non-profit, and we depend on readers like you to drive our public-interest journalism efforts. Donate Rs 500; Rs 1,000, Rs 2,000.”