2% Of Indians & 380,000 Companies Doubled Direct Tax Revenue In 5 Years

| Highlights * Direct tax collection has been exceeding budget estimates, and has almost doubled over the years from 2006 to 2011. * Corporate sector accounted for 63.5% of Rs 1,38, 921 crore revenue foregone in 2010-11. * Maharashtra, Delhi and Karnataka account for over 61% of direct tax collected across the country; Lakshadweep, Mizoram and Nagaland collect minimum tax. |

The good news. The Indian economy grew at 6.9% (at factor cost of 2004-05 prices) in 2011-12 while many parts of the world slowed down. The Economic Survey 2011-12 puts per capita net national income (at current factor cost) at Rs 60,972, an increase of 14% from Rs 53,331 in 2010-11.

IndiaSpend’s Prachi Salve looks at the latest report by the government auditor, Comptroller and Auditor General (CAG), and finds that while the economy has been growing, only 2.7% of India’s 1.2 billion population pay tax or only 33.5 million citizens pay income tax, marginally up from 31.3 million tax payers in 2006-07.

Now, some key findings: Direct tax collection has been exceeding budget estimates, and has almost doubled over the years from 2006 to 2011.

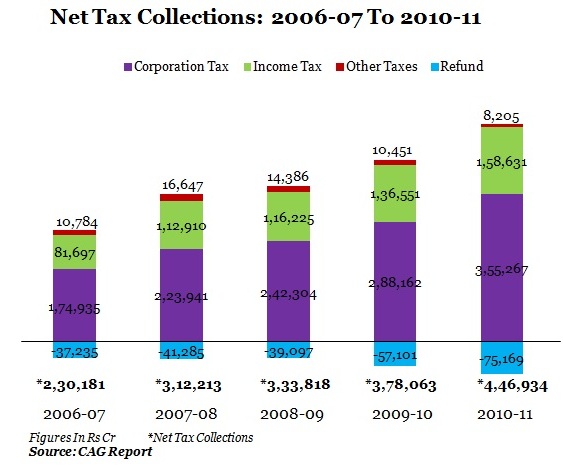

Direct tax collected has increased from Rs 2,30,181 crore in 2006-07 to Rs 4,46,934 crore in 2010-11, an increase of 94.2%.

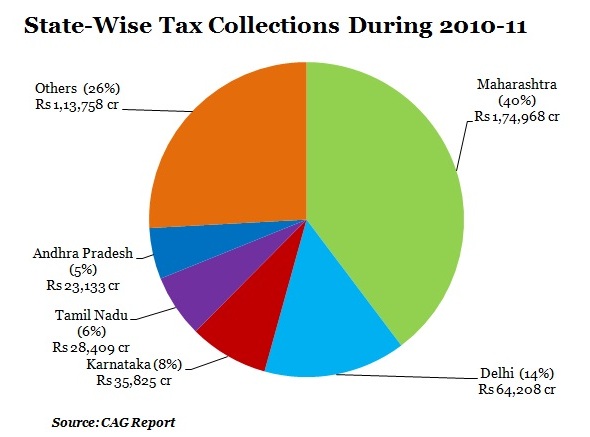

Maharashtra, Delhi and Karnataka account for over 61% of the total direct tax collectedacross the country.

Focus On Direct Taxes

Taxes play two important roles in an economy: first, they are revenue resources that can be utilised for development, and second they help create equality through progressive taxation. Let us look at the five-year data on direct tax collections:

From the above graph, it is clear that corporation tax forms a major part of direct taxes collected in the country followed by income tax. The share of corporation tax in gross tax collections increased from 65% in 2006-07 to 68% in 2010-11.The share of income tax has been around 30% during the same time period.

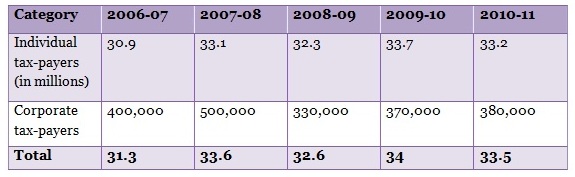

Growth Of Tax Payers

Not only has there been an increase in the amount of tax collected, there has also been an increase in the number tax payers. Table 2 looks at the increasing number of tax payers from 2006-07 to 2010-11:

Table 1: Increasing Tax Base

Source: CAG Report

The individual tax payer base has increased from 31.3 million in 2006-07 to 33.5 million in 2010-11, an increase of 7%. The taxpayer base did decline from its highest point of 33.7 million in 2009-10 to 33.2 million people in 2010-11. Another interesting facetis that tax collections increased 94.2% during the same period. So, increase in tax collection was 13 times the increase in taxpayer base!

The corporate tax payer base, on the other hand, declined from 400,000 companies to 380,000 companies during the same period. Interestingly, there were 720,000 working companies registered in the country by the office of Registrar of companies (ROC) as on March 2011. However, only 380,000 companies paid taxes, which left around 340,000 companies un-reconciled.

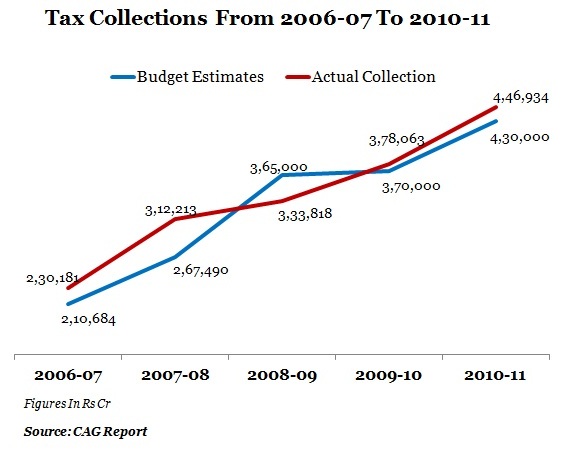

Meeting Targets All The Time

Tax collections have always surpassed budget estimates in the past five years:

It can be seen from from the above graph that tax collections have been higher than budget estimates each year with the exception of 2008-09 when collections declined 8.5% than budget estimates. Furthermore, the increase in tax collections moved up from 9.2% in 2006-07 to 16.7% in 2007- 08. But there was only a slight increase in tax collections as compared to budget estimates in 2009-10 and 2010-11.

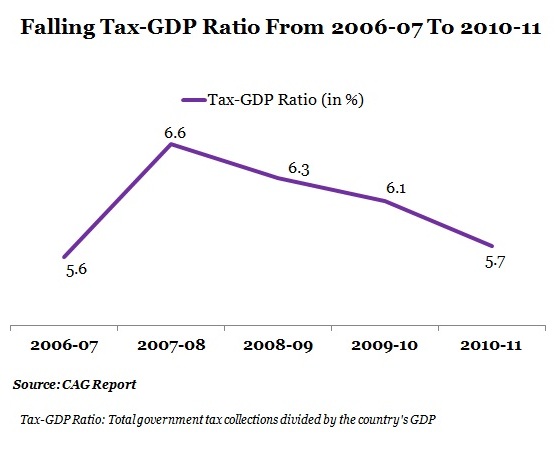

However, the share of direct taxes to Gross Domestic Product (GDP) has declined from 6.6% in 2007-08 to 5.7% in 2010-11.

Maharashtra, Delhi Top The List

Three states - Maharashtra, Delhi and Karnataka – account for around 61% of direct taxes collected all over the country. The collection rate has been determined in the context of the permanent account number (PAN) card. The split is as follows; Maharashtra with 39.2%, Delhi with 14.4% and Karnataka 8%.

And the lowest tax collecting states were Lakshadweep (Rs 1.77 crore), Mizoram (Rs 6.89 crore) and Nagaland (Rs 19.29 crore).

Revenue Foregone

The government provides tax preferences in the form of special rates, exemptions, deductions and rebates to promote savings by individuals, boost exports, balance regional growth, and encourage investments in capital-intensive projects like infrastructure.

These benefits are availed by both individual tax payers and corporate tax payers. The revenue foregone as a result of rebates increased 111.8% from Rs 65,587 crore in 2006-07 to Rs 1,38,921 crore in 2010-11. And the corporate sector accounted for 63.5% of the revenue foregone in 2010-11.

Clear Tasks Ahead

So, the challenges are clear: government must increase tax base by not just increasing the number of individual tax payers but also bringing in more corporate tax payers. And there is also a need to reduce the revenue foregone by curtailing the rebates given to the corporate sector.